Di Roger Peverelli e Reggy de Feniks – Fondatori di The DIA Community.

Sin dal suo lancio, 25 anni fa in Sud Africa, Discovery è stato pioniere nell’uso delle scienze comportamentali e del benessere legate all’assicurazione sanitaria. Oggi, Discovery è un’istituzione finanziaria globale che offre un’ampia gamma di prodotti assicurativi e di investimento a breve termine e sta ora entrando nel settore bancario. Con un mercato primario in Sud Africa, Regno Unito, Cina e Stati Uniti e partnership assicurative in altri 15 paesi, Discovery serve circa 19 milioni di clienti in tutto il mondo. Abbiamo chiesto ad Andre Nepgen, responsabile della rete Vitality globale di Discovery, di condividere alcuni dei segreti del successo del programma Discovery’s Vitality. Si tratta davvero di creare ecosistemi con tutti i tipi di partner, afferma.

DIA Munich (17-18 ottobre) è un evento da non perdere per insurtech e innovazione nel settore assicurativo. Alla recente edizione di primavera abbiamo accolto 1.200 dirigenti assicurativi e leader di insurtech in rappresentanza di 50 paesi e 6 continenti; di cui il 60% era a livello C e C-1. Controllare il sito Web DIA per i biglietti e ulteriori informazioni: http://www.digitalinsuranceagenda.com/

I lettori di Assinews.it avranno la possibilità di partecipare alle 2 giornate di Monaco (17-18 Ottobre 2018) godendo di uno sconto di €200 euro digitando il codice 200DIA2018MASSINEWS al momento della registrazione: http://www.digitalinsuranceagenda.com/dia-munich-2018/#register

____________________

Right from its launch, 25 years ago in South Africa, Discovery pioneered the use of behavioral sciences and wellness linked to health insurance. Today, Discovery is a global financial institution, offering a wide range of insurance and short term investment products and the company is now moving into banking as well. With a primary market in South Africa, the UK, China and the US, and insurance partnerships in 15 other countries, Discovery serves about 19 million customers globally. We’ve asked Andre Nepgen, head of the global Vitality network at Discovery, to share some of the secrets behind the success of Discovery’s Vitality program. It’s really about creating ecosystems with all sorts of partners, he says.

DIA Munich (17-18 October) is the must-see event for insurtech and innovation in insurance. At the recent Spring edition we welcomed 1,200 insurance executives and insurtech leaders representing 50 countries and all 6 continents; of which 60% was C-level and C-1. Check the DIA-Website for tickets and more information: http://www.digitalinsuranceagenda.com/

Andre, could you expand a bit on the essence of the Discovery business model?

Andre: “At the core of our business, there is a very simple ‘why’, ‘how’ and ‘what’ we do. And it’s clear wherever you go in the organization that everyone knows this. This is why we do it: we want to make people healthier and enhance and protect their lives. The how is called ‘the Vitality shared-value insurance model’ and I’ll talk about this a little bit later. What we do is insurance, banking and investments.”

Obviously, the way that Discovery’s answers to the why’, ‘how’ and ‘what’ questions are totally in sync explains part of its success. But probably it begins with the fact that the answer to the ‘why’ question, Discovery’s mission, ‘wanting to make people healthier and enhance and protect their lives’, strikes the right chord among customers. What are the key trends you’re tapping into?

Andre: “We believe there are three global trends that are shaping and potentially disrupting the insurance industry globally.

The first trend is the ever-changing nature of risk. We’re all familiar with this; 50 years ago the nature of risk was all about infections and pre-existing conditions and we used to underwrite according to that unwarrantedly. Nowadays we see that risk is largely behavioral. We see that ‘diseases of lifestyle’ – such as lack of exercise, smoking, poor nutrition and alcohol abuse – explain the majority of death and the majority of disease. This is similar to what we see in car and home insurance: 80% of all accidents are a result of poor driving behavior. So, risk is largely behavioral.

The second trend we identified is that of technology. Technology has become a complete enabler of insurers, especially with the proliferation of wearable devices. So, now, from an insurance point of view, we are able to assess risk on a more granular basis, and more frequently. Vivametrica, which was also part of the previous DIA Amsterdam line-up, serves as an illustration.

The third and last trend is that of social responsibility. Insurers are increasingly confronted with the challenge of looking beyond financials and having a social purpose.”

Vivametrica offers a life insurance underwriting solution that is more predictive, faster and less expensive and doesn’t need any fluids or exams. They use digital biomarkers from wearables and other personal sensor data, to provide risk predictors for specific chronic diseases and mortality. This results in more sophisticated underwriting, more cost savings, much better customer engagement.

Granted that these trends exert pressure on insurers and have a potential disrupting effect on the landscape, how did Discovery react to these trends? How did you translate these trends into the Vitality business model that you mentioned?

Andre: “The ‘Vitality shared-value insurance model’ is actually quite straightforward. By making members healthier and more engaged, the insurer benefits through lower mortality, morbidity and lapses. When these factors come together, they give an actuarial surplus to the insurer. What the insurer then does, is take the surplus generated and feed that back to the member in the form of incentives that create behavioral change. As a result, we see a wonderful loop where the member gets healthier, the insurer profits and rewards the member for that behavior change, which is good for the member (health-wise and finance-wise), good for the insurer (profit-wise) and good for society (in terms of a healthier and more productive workforce).”

The Vitality model has been so successful that it is now also being used in a number of other geographies, making it the largest behavioral insurance platform globally.

Andre: “Yes, we are lucky to partner with great insurance companies such as AIA in South-east Asia, Generali in continental Europe, John Hancock in the United States, Manulife in Canada and Ping An in China. The Vitality program with Sumitomo in Japan will be coming very soon as well. All these insurers are making use of the Vitality model for their consumer proposition. The platform is growing at a rapid rate. At present, we are adding roughly 200,000 new members every single month.”

A perfect example of creating ‘network effects’, leveraging the market access of established players. On top of that you’re of course also accumulating all sorts of data along the way, so-called ‘stored value’, that can be deployed to further improve the business model.

Andre: “The model is built on a foundation of 40 million life years of health, life and insurance data linked to wellness behavior. To give you a bit more granularity; every single minute this platform tracks roughly a 1,000 activities and picks up about 50 biometric readings. And these numbers just continue to grow as we go along. My role in this global Vitality network is to come up with partners, programs and products, as well as technology solutions and data infrastructure to support this platform and to help our partners.”

With all these new data streams and such massive amounts of data you must be continuously learn new things that go beyond the traditional actuarial models.

Andre: “A particular behavior that I consider to be probably the most exciting one is ‘exercise’. We at Vitality are sort of obsessed with exercise. It is also a particular application of the Vitality model.

We have learned that exercise is often the trigger to get people to live a healthier lifestyle. For instance, we know from data that as soon as someone starts exercising, they tend to eat healthier and to take preventative measures, do more on-line assessments, and just generally live a healthier life. So, exercise is often the precursor for someone changing their behavior.

At the same time, from an insurance point of view, exercise is probably one of the biggest predictors of mortality risk. We know from our data that people who are physically active exhibit less than 50% of the mortality rate of the average population and if you break that part by how active they actually are, it actually drops down to less than 30% of the mortality rate.

We’ve also looked at our healthcare data, being able to track people over time. The results showed that by making people more active, their healthcare costs go down. Both in terms of frequency and severity in terms of a hospital stay. And it goes both ways: once people stop exercising the effect reverses.”

Over the last decade Discovery has built an impressive ecosystem of partnerships with companies that help with this. Ranging from health and fitness partners such as Virgin Active (gyms) and Woolworths (supermarkets), where Vitality members enjoy up to 25% discount on healthy food items, to reward partners that include for instance Emirates and British Airways. Can you give a concrete example of how such a partnership contributes to an increase in time spent on exercising?

Andre: “Roughly 2 years ago we entered into collaboration with Apple and we launched a benefit called Vitality Active Rewards with Apple Watch.

Let me share the initial results of that particular intervention in insurance. The user journey for the Vitality Active Rewards with Apple Watch is quite simple. As an insurance client, you get an Apple Watch upfront for a small activation fee and you enter a contract with the insurance company to repay that Apple Watch over a 24-month period in equal instalments (interest-free). The incentive to exercise is that repayment will reduce to 0 if you’re physically active within that month. We set you a weekly exercise goal. This goal is personalized and it is also adjusted for people with critical illness. It’s dynamic in the sense that it keeps on challenging you: it intensifies every single week so you push yourself a little bit harder and it dynamically adjusts downwards when you stop engaging. Customers engaging in this receive micro-rewards at the end of every week such as coffees, smoothies, and, in some countries, you can donate to a charity.”

You’re actively driving engagement. And it seems that the way it works is driven by behavioural science. How is the benefit you implemented preferred over letting people buy the Apple Watch themselves and giving them their money back at the end of every month?

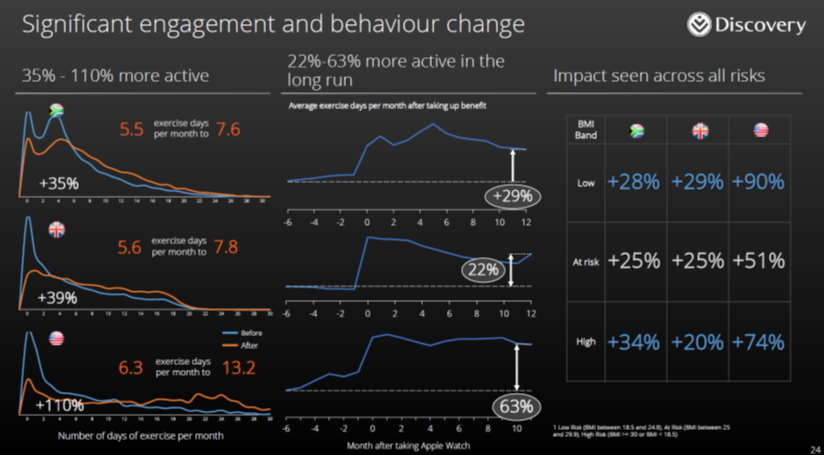

Andre: “That’s a question we often receive and yes, our benefit makes sense from a behavioral point of view. Essentially, it’s about loss aversion. According to behavioural sciences we experience a lot less benefit or we feel a lot worse for a loss of equal amount to that of a gain of that same amount. Put differently, we like to avoid losses. Now, if you think about the Apple Watch benefit, we give someone the watch for free and tell them that they are going to incur a loss every single month to the value of that repayment. What you see is that people engage dramatically. People change their behavior just to avoid that loss, making this a powerful tool to create a behavior change in insurance. Although it is still early from an insurance point of view, I can share some of the outcomes we see in our most mature countries: South Africa, the US and the UK. We see a dramatic change in exercise that ranges between 35 to 100% increase in physical activity. And we’re not just tracking the members now, we’ve been tracking members before by using other devices, which confirms this behavioral change. It’s also interesting to look at the distribution of activity and how people are exercising. We’ve managed to change distribution – not only do people exercise more on average, we have made many people who rarely exercise change their lifestyle, hopefully for good.”

Those results are impressive, especially when seen from an insurance point of view! Do these results hold up after the initial peak?

Andre: “Usually, when you give someone an incentive it works for a few weeks and then they drop off. We know from studies around wearable devices that when people get a wearable device they love it, they engage with it, they increase their activity, and then slowly engagement drops off over time. But given the nature of this benefit that extends over a 24-month period we simply did not see that. The activity levels of people over time show that those people with the benefit and those people with the Apple Watch, do continue to engage. So, there is a peak that shows an uplift in engagement and an increase in activity, but that sorts of flattens off and it remains at remarkably high levels. We certainly hope that this will continue and we’ve changed the behavior of these people for good and it appears that it’s the same for every single country we go to.”

That’s fantastic, congratulations on these results. Does the benefit consider existing differences in exercise, such as different intensity work-outs?

Andre: “Yes, 10,000 steps versus a 30-minute high-intensity exercise are two very different things. And there’s a lot of clinical evidence telling us that a high intensity exercise is a lot better. So, we’ve designed the goals to make it easier for people to achieve their weekly goals if they just do different forms of exercise: high intensity exercises. By changing the goals in that nature we’ve actually made people exercise with a higher heart rate. We’ve seen roughly a 32% increase in a portion of people doing high intensity exercises. And, from an insurance point of view, that is quite a big increase.”

Behavioral programs often tend to target the already-actives.

Andre: “Not necessarily, the population we looked at was all our clients classified by BMI. The behavior change that we observed, was evident across all BMI levels: people who have a good BMI, people that are slightly over and especially those people with a high BMI. Interestingly, we saw the biggest change in exercise with people that are obese. We also considered whether people with chronic conditions take part in the exercise and the answer is positive. People with diabetes saw a 68% increase in physical activity. But the bottom right corner was the one I found most interesting: smokers actually had the biggest behavioral change out of all.”

As we see people getting healthier in general, how do you confirm this model is having an impact?

Andre: “That’s a relative question. We’re still at an early stage, usually it’s very difficult to track behavioral change after less than two years, given that you have biometric readings at a discrete point in time. So, we’ve looked at the BMI of these groups of members over time to see if they did actually lose weight and if they actually did get healthier. I can tell you that a 3% percent and a 2% change might not seem a lot, from an insurance point of view that is significant. Compared to the general population and almost every country we’ll be seeing BMI actually increasing over time – and the fact that the program has reversed this is exciting.”

You aspire for people to get healthier both from a societal as from an insurance point of view.

Andre: “Exactly. Also, I would like to shortly share another interesting example from this data. In some countries, there is an event called Parkrun: every Saturday at 8 o’clock in the morning, people in participating countries run a 5km route and this course duration is measured. We wanted to use our data to observe whether we are making people better athletes and whether these people are getting some sense of achievement using our program. So, we partnered with Parkrun and from their data we found that people with this benefit are actually running faster! When you’re a runner, cutting back a minute of your 5km time is quite a lot of hard work. I saw a 13 second per kilometer improvement for the members who use this benefit. So, people are becoming faster in a sense of achievement. This roughly translates to a 4% increase in cardiovascular fitness which has a big clinical benefit.”

So, thanks to your ecosystem, thanks to all these different partnerships, you’re able to discover many new levers to create behavior change across all risk segments, with great health improvements. What is your view on translating this into insurance savings?

Andre: “Although it’s still an early stage, we’re seeing exactly that. First is just a cross-sectional look at the people with the Apple Watch and the benefit from the Vitality Active Rewards with Apple Watch. From a health point of view, the data shows that people with the benefit have an 18% lower chronic and healthcare claimed cost. From an insurance point of view, I think, especially when it comes to life insurance, where people transact maybe on an annual basis (if that much), we’ve seen a 12 times increase in digital engagement with massive opportunities around that. And, importantly, we see a change the lapse behavior of people. Lapse can be a source of actuarial surplus and we’re seeing on the health and life side that there’s a decrease in lapses. 81% decrease compared to the normal population which is particularly important for a very simple reason, namely that traditionally the healthy leave and the sick stay, because the sick need cover and the healthy see less and less value out of it. Using this benefit, we have effectively altered that relationship. What happens now is that the insurance book becomes less risky over time as the healthy people stay as well as the sick – and hopefully we will improve their health over time.

But what is most important: by using technology and an ecosystem of partnerships as enablers, we’ve been able to develop a model to change behavior and to address the social need of making people healthier.”